3 Swedish Growth Stocks With Up To 37% Insider Ownership

As global markets navigate rising oil prices and geopolitical tensions, European indices, including Sweden's, have experienced cautious investor sentiment. In this climate, Swedish growth companies with significant insider ownership can offer a unique perspective on aligning leadership interests with shareholder value.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 24.8% |

Truecaller (OM:TRUE B) | 29.6% | 21.6% |

Fortnox (OM:FNOX) | 19.1% | 22.2% |

Biovica International (OM:BIOVIC B) | 18.2% | 78.5% |

Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

BioArctic (OM:BIOA B) | 34% | 98.4% |

Yubico (OM:YUBICO) | 37.5% | 42.3% |

KebNi (OM:KEBNI B) | 36.3% | 86.1% |

InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

OrganoClick (OM:ORGC) | 23.1% | 109.0% |

We'll examine a selection from our screener results.

Pandox

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pandox AB (publ) is a hotel property company that owns, develops, and leases hotel properties worldwide, with a market cap of SEK40.67 billion.

Operations: Pandox generates revenue through its own operations, amounting to SEK3.27 billion, and from rental agreements, totaling SEK3.82 billion.

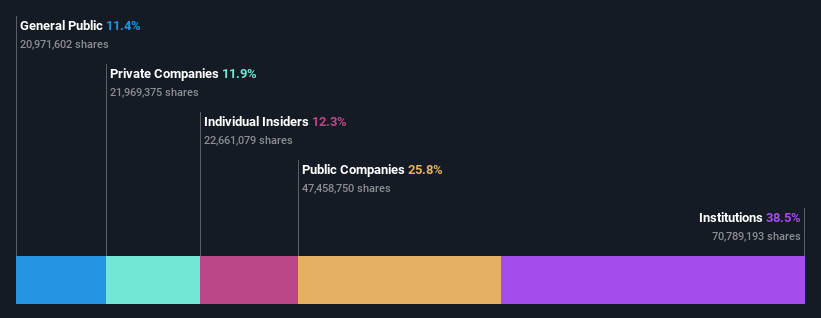

Insider Ownership: 19.9%

Pandox AB has demonstrated growth potential with earnings forecasted to rise 27% annually, outpacing the Swedish market. Recent insider activity shows more shares bought than sold, indicating confidence in its prospects. The company has expanded through acquisitions like DoubleTree by Hilton Edinburgh City Centre and is negotiating a significant hotel portfolio purchase in London. However, recent equity offerings have diluted shareholders, and interest payments are not well covered by earnings despite improved net income.

Dive into the specifics of Pandox here with our thorough growth forecast report.

Our valuation report here indicates Pandox may be overvalued.

AB Sagax

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company operating in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market cap of SEK101.26 billion.

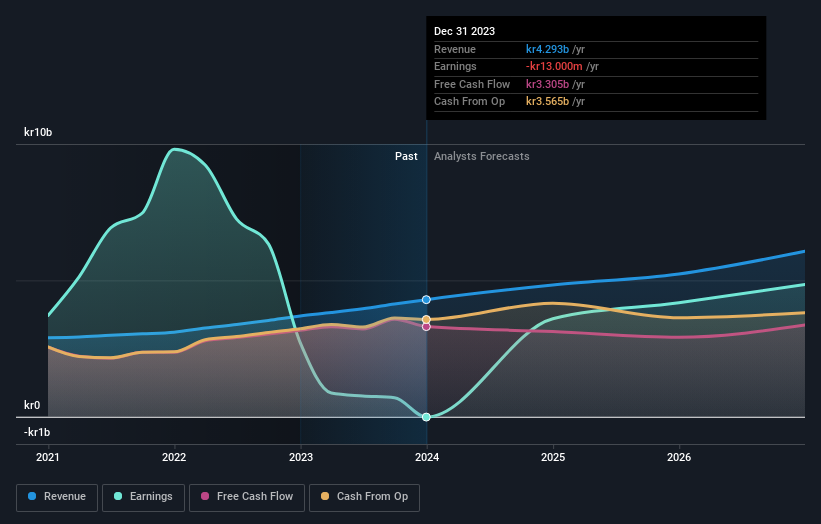

Operations: The company generates revenue primarily through its real estate rental segment, which amounts to SEK4.63 billion.

Insider Ownership: 28.6%

AB Sagax's earnings are forecast to grow 29.1% annually, surpassing the Swedish market's growth rate. Despite past shareholder dilution, the company has shown robust financial performance with a net income of SEK 2.06 billion for the first half of 2024, a significant turnaround from a loss in the previous year. Revenue growth is expected at 9.3% annually, outpacing the market average but still below high-growth benchmarks, while debt coverage remains an area for improvement.

Click to explore a detailed breakdown of our findings in AB Sagax's earnings growth report.

Upon reviewing our latest valuation report, AB Sagax's share price might be too optimistic.

Yubico

Simply Wall St Growth Rating: ★★★★★★

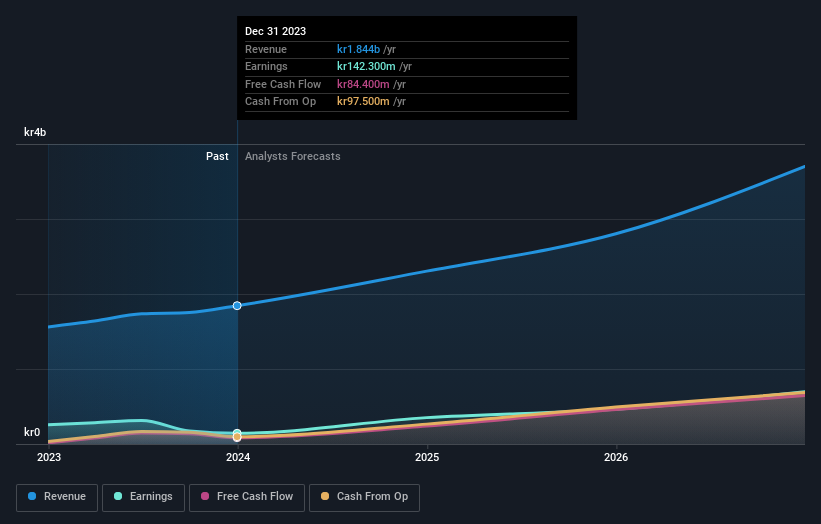

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of SEK22.73 billion.

Operations: The company generates revenue from the Security Software & Services segment, totaling SEK2.09 billion.

Insider Ownership: 37.5%

Yubico demonstrates strong growth potential with earnings forecasted to rise 42.3% annually, significantly outpacing the Swedish market. Recent financial results reveal a substantial revenue increase to SEK 1.11 billion for the first half of 2024, though profit margins have declined from last year. The company benefits from high insider ownership and strategic partnerships, such as its collaboration with Straxis on secure web applications for defense organizations, which could enhance its competitive edge in cybersecurity solutions.

Where To Now?

Unlock more gems! Our Fast Growing Swedish Companies With High Insider Ownership screener has unearthed 76 more companies for you to explore.Click here to unveil our expertly curated list of 79 Fast Growing Swedish Companies With High Insider Ownership.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:PNDX B OM:SAGA A and OM:YUBICO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com