3 SGX Stocks Estimated At 26.7% To 39.9% Below Intrinsic Value

As the Singapore market navigates a period of economic uncertainty, investors are increasingly on the lookout for opportunities that promise value amidst fluctuating indices. In this environment, identifying undervalued stocks becomes crucial, as these investments can offer potential growth when aligned with solid fundamentals and favorable market conditions.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

Name | Current Price | Fair Value (Est) | Discount (Est) |

Singapore Technologies Engineering (SGX:S63) | SGD4.69 | SGD7.33 | 36% |

Digital Core REIT (SGX:DCRU) | US$0.615 | US$0.83 | 25.7% |

Nanofilm Technologies International (SGX:MZH) | SGD0.86 | SGD1.43 | 39.9% |

Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.17 | SGD1.60 | 26.7% |

Seatrium (SGX:5E2) | SGD1.75 | SGD2.96 | 40.9% |

Here we highlight a subset of our preferred stocks from the screener.

Frasers Logistics & Commercial Trust

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust that manages a diversified portfolio of 107 industrial and commercial properties valued at approximately S$6.4 billion across Australia, Germany, Singapore, the United Kingdom, and the Netherlands, with a market capitalization of S$4.40 billion.

Operations: Frasers Logistics & Commercial Trust generates revenue from its diversified portfolio of 107 industrial and commercial properties located in Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

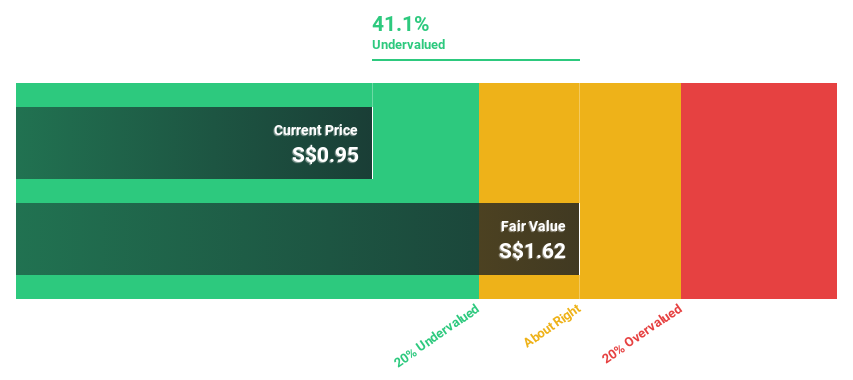

Estimated Discount To Fair Value: 26.7%

Frasers Logistics & Commercial Trust is trading at S$1.17, significantly below its estimated fair value of S$1.6, suggesting it may be undervalued based on discounted cash flow analysis. Despite a forecasted low return on equity and unstable dividend history, the trust is expected to become profitable within three years with earnings growth projected at 39.37% annually, surpassing average market growth. Recent board changes reflect ongoing succession planning efforts.

Nanofilm Technologies International

Overview: Nanofilm Technologies International Limited offers nanotechnology solutions across Singapore, China, Japan, and Vietnam, with a market cap of SGD559.93 million.

Operations: The company's revenue is derived from several segments, including Sydrogen at SGD1.40 million, Nanofabrication at SGD18.37 million, Advanced Materials at SGD153.32 million, and Industrial Equipment at SGD28.71 million.

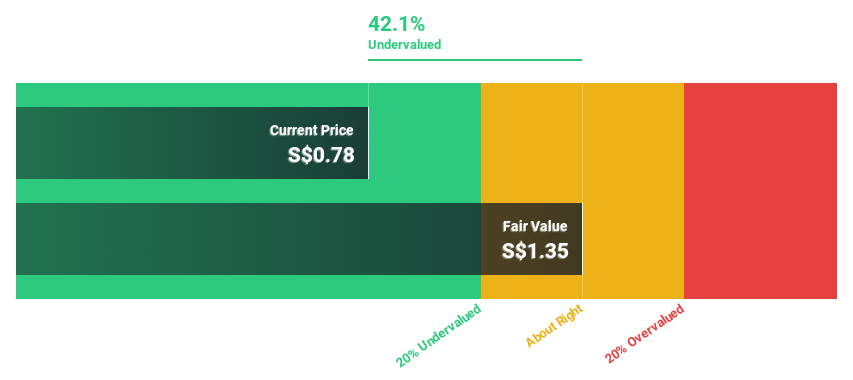

Estimated Discount To Fair Value: 39.9%

Nanofilm Technologies International is trading at S$0.86, well below its estimated fair value of S$1.43, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from 8.7% to 3.8%, earnings are forecasted to grow significantly at 54% annually, outpacing the Singapore market's growth rate of 10.1%. Recent board changes and financial guidance indicate strategic shifts as the company navigates challenges and anticipates improved revenue performance in the second half of 2024.

Singapore Technologies Engineering

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market cap of SGD14.62 billion.

Operations: The company generates revenue from three main segments: Commercial Aerospace (SGD4.34 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.54 billion).

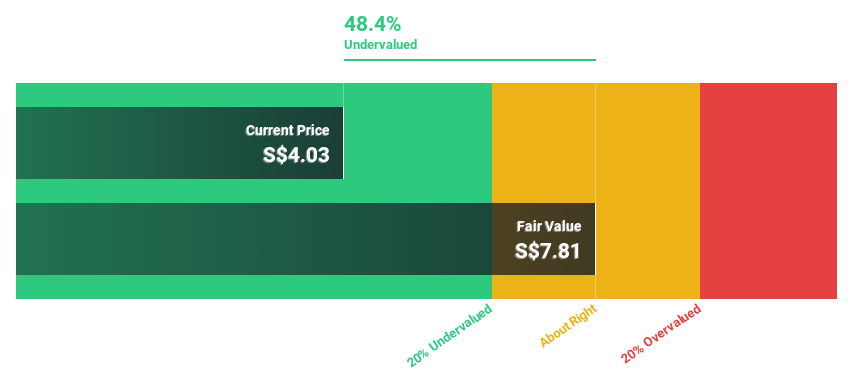

Estimated Discount To Fair Value: 36%

Singapore Technologies Engineering is trading at S$4.69, significantly below its estimated fair value of S$7.33, suggesting undervaluation based on cash flows. Earnings are projected to grow 11.3% annually, outpacing the Singapore market's growth rate of 10.1%. However, debt coverage by operating cash flow remains a concern. Recent strategic alliances in quantum security and a strong earnings performance with net income rising to S$336.53 million bolster its potential for future growth initiatives.

Make It Happen

Explore the 5 names from our Undervalued SGX Stocks Based On Cash Flows screener here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:BUOU SGX:MZH and SGX:S63.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com