3 SGX Dividend Stocks To Watch With Up To 9.5% Yield

As the Singapore market continues to navigate post-pandemic economic adjustments, investors are keeping a keen eye on labor market trends and their implications for inflation and growth. With firms' perceptions of labor tightness returning to pre-pandemic levels, dividend stocks remain an attractive option for those seeking steady income in a fluctuating environment. A good dividend stock typically offers consistent payouts and resilience against economic shifts, making them particularly appealing in today's climate.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 6.75% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.22% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.29% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.36% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.11% | ★★★★★☆ |

QAF (SGX:Q01) | 6.02% | ★★★★★☆ |

Aztech Global (SGX:8AZ) | 9.71% | ★★★★☆☆ |

Oversea-Chinese Banking (SGX:O39) | 5.89% | ★★★★☆☆ |

Delfi (SGX:P34) | 6.51% | ★★★★☆☆ |

Nordic Group (SGX:MR7) | 4.00% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Multi-Chem

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Multi-Chem Limited is an investment holding company that distributes information technology products across Singapore, Greater China, Australia, India, and internationally with a market cap of SGD250.46 million.

Operations: Multi-Chem Limited generates revenue from its IT business in Singapore (SGD407.17 million), India (SGD54.17 million), Australia (SGD50.04 million), and other regions (SGD135.87 million), as well as from its PCB business in Singapore (SGD1.69 million).

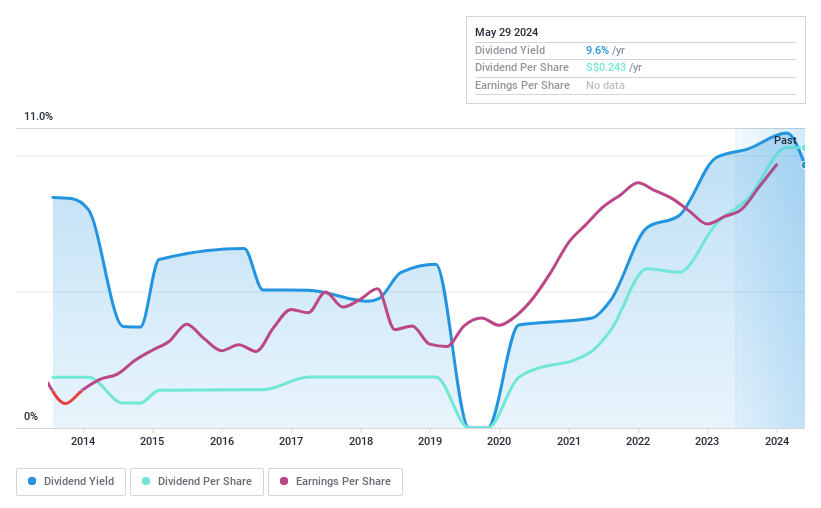

Dividend Yield: 9.6%

Multi-Chem's dividend yield of 9.57% ranks in the top 25% of Singapore's market, but its sustainability is questionable due to a high cash payout ratio of 1054.3%. Despite recent earnings growth and an interim dividend increase to S$0.111 per share, dividends have been volatile over the past decade. The price-to-earnings ratio at 7.8x suggests good value compared to the market average, but significant insider selling raises concerns about future stability.

China Sunsine Chemical Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals globally, with a market cap of SGD467.26 million.

Operations: China Sunsine Chemical Holdings Ltd. generates its revenue primarily from Rubber Chemicals (CN¥4.39 billion), followed by Heating Power (CN¥202.99 million) and Waste Treatment (CN¥25.06 million).

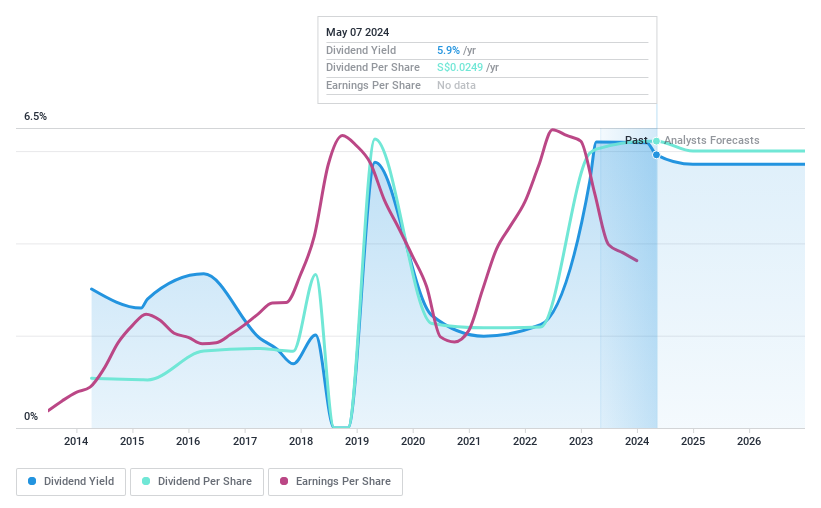

Dividend Yield: 5%

China Sunsine Chemical Holdings offers a dividend yield of 5.03%, which is below Singapore's top 25% dividend payers. The company's dividends are well covered by earnings and cash flows, with payout ratios of 21.1% and 34%, respectively, but have shown volatility over the past decade. Recent earnings results for the first half of 2024 reported sales of CNY 1.75 billion and net income of CNY 188.8 million, indicating stable financial performance despite slight declines from the previous year.

United Overseas Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Overseas Bank Limited, along with its subsidiaries, offers a range of banking products and services globally and has a market capitalization of SGD53.28 billion.

Operations: United Overseas Bank Limited generates revenue primarily from Group Wholesale Banking (SGD6.69 billion), Group Retail (SGD5.11 billion), and Global Markets (SGD400 million).

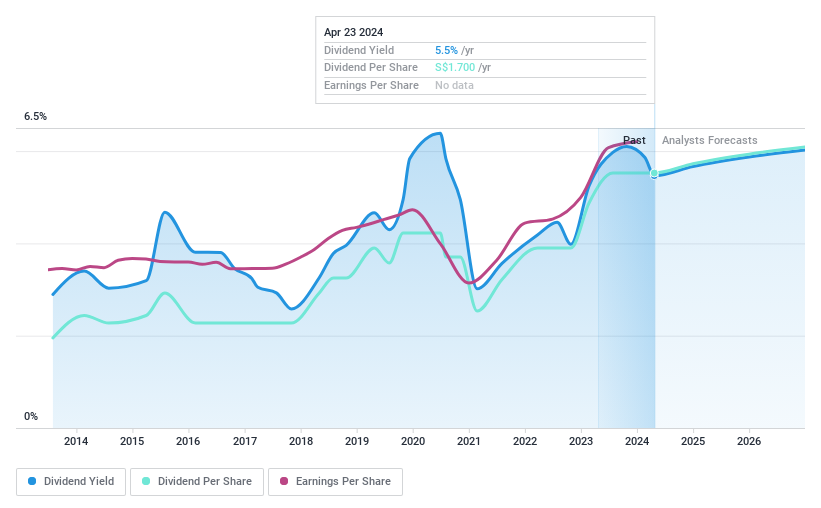

Dividend Yield: 5.5%

United Overseas Bank's dividend yield of 5.52% is slightly below the top 25% of Singapore's dividend payers. The dividends are covered by a payout ratio of 51.9%, with future coverage expected to remain stable at 49.8%. Despite past volatility in dividend payments, recent earnings show stability, with net income reported at S$2.91 billion for H1 2024. A recent £750 million fixed-income offering may enhance financial flexibility for sustaining dividends.

Summing It All Up

Click here to access our complete index of 19 Top SGX Dividend Stocks.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:AWZ SGX:QES and SGX:U11.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com