3 Indian Growth Stocks Insiders Are Eager To Hold

The Indian market has experienced a flat week recently but has shown impressive growth over the past year with a 40% increase, and earnings are expected to grow by 17% annually. In such an environment, stocks with high insider ownership can be particularly appealing as they often reflect confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 30.8% |

Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

Rajratan Global Wire (BSE:517522) | 18.3% | 35.8% |

KEI Industries (BSE:517569) | 19.2% | 21.9% |

Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

Aether Industries (NSEI:AETHER) | 31.1% | 45.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Syrma SGS Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Syrma SGS Technology Limited offers turnkey electronic manufacturing services across India, the United States, Germany, and other international markets, with a market cap of ₹73.76 billion.

Operations: The company's revenue is primarily derived from its electronic manufacturing services segment, which generated ₹37.12 billion.

Insider Ownership: 27.8%

Revenue Growth Forecast: 21.8% p.a.

Syrma SGS Technology's revenue is forecast to grow at 21.8% annually, outpacing the Indian market's growth rate of 10.2%, while earnings are expected to increase by a significant 31.5% per year. Despite lower profit margins compared to the previous year, these growth projections highlight its potential as a dynamic player in India's tech sector. Recent changes include appointing new statutory auditors and announcing Q1 sales of ₹11.75 billion, reflecting substantial year-over-year growth.

TBO Tek

Simply Wall St Growth Rating: ★★★★★☆

Overview: TBO Tek Limited operates travel distribution platforms in India and internationally, with a market cap of ₹183.23 billion.

Operations: The company's revenue is primarily derived from its Hotels and Packages segment, generating ₹10.88 billion, followed by Air Ticketing at ₹3.44 billion.

Insider Ownership: 23.3%

Revenue Growth Forecast: 18.4% p.a.

TBO Tek's earnings are forecast to grow significantly at 29.8% annually, surpassing the Indian market average of 17.3%. Despite revenue growth expectations of 18.4% per year being slightly below the 20% mark, they still exceed the market's rate of 10.2%. Recent developments include its addition to the S&P Global BMI Index and a change in statutory auditors, with no material financial impact from a recent GST notice for past tax discrepancies.

Take a closer look at TBO Tek's potential here in our earnings growth report.

The valuation report we've compiled suggests that TBO Tek's current price could be inflated.

Varun Beverages

Simply Wall St Growth Rating: ★★★★★☆

Overview: Varun Beverages Limited, along with its subsidiaries, operates as a franchisee for PepsiCo's carbonated soft drinks and non-carbonated beverages, with a market capitalization of ₹1.92 trillion.

Operations: The company's revenue from its manufacturing and sale of beverages segment is ₹180.52 billion.

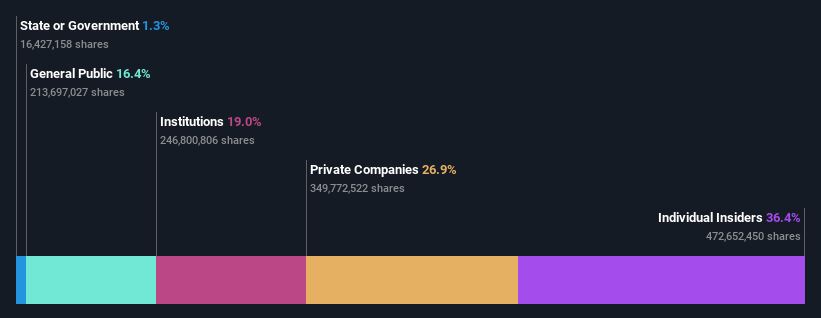

Insider Ownership: 36.2%

Revenue Growth Forecast: 15.4% p.a.

Varun Beverages is seeking INR 75 billion via a Qualified Institutional Placement to fund growth initiatives, including expanding its product portfolio and strategic acquisitions. The company recently announced a USD 50 million investment in the Democratic Republic of the Congo for a new Pepsi facility. Despite high debt levels, Varun's earnings are expected to grow significantly at 22.4% annually, outpacing the Indian market average of 17.3%, with revenue growth forecasted at 15.4%.

Seize The Opportunity

Dive into all 91 of the Fast Growing Indian Companies With High Insider Ownership we have identified here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:SYRMA NSEI:TBOTEK and NSEI:VBL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com