3 Growth Stocks On Euronext Amsterdam With Up To 108% Earnings Growth

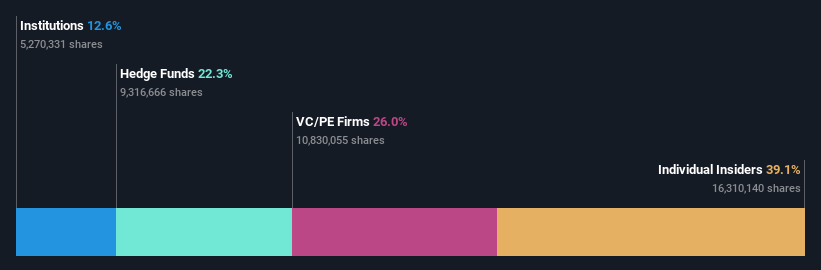

As European markets navigate the complexities of geopolitical tensions and economic shifts, the Netherlands continues to present intriguing investment opportunities, particularly within its growth sector. With insider ownership often seen as a positive indicator of alignment between management and shareholders, identifying companies with strong earnings growth on Euronext Amsterdam can be particularly appealing in such uncertain times.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

Name | Insider Ownership | Earnings Growth |

Envipco Holding (ENXTAM:ENVI) | 36.7% | 83.7% |

Ebusco Holding (ENXTAM:EBUS) | 31% | 107.8% |

MotorK (ENXTAM:MTRK) | 35.7% | 108.4% |

Basic-Fit (ENXTAM:BFIT) | 12% | 77.7% |

CVC Capital Partners (ENXTAM:CVC) | 20.2% | 31% |

PostNL (ENXTAM:PNL) | 35.6% | 36.4% |

Let's explore several standout options from the results in the screener.

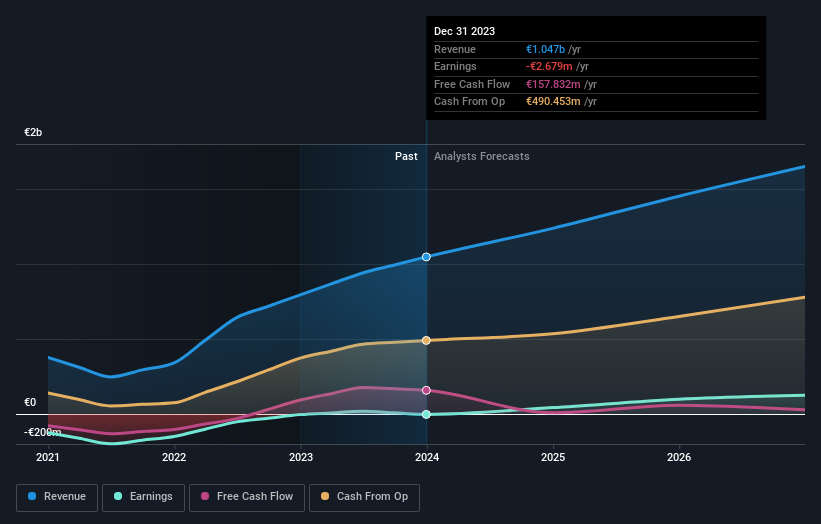

Basic-Fit

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V., along with its subsidiaries, operates fitness clubs and has a market cap of €1.64 billion.

Operations: The company generates revenue from its fitness clubs primarily in the Benelux region, contributing €505.17 million, and in France, Spain, and Germany, which together account for €626.41 million.

Insider Ownership: 12%

Earnings Growth Forecast: 77.7% p.a.

Basic-Fit shows promising growth potential with forecasted earnings growth of 77.7% annually, outpacing the Dutch market. Despite profit margins declining to 0.7%, revenue increased to €584.76 million for H1 2024, compared to €500.42 million last year, and net income turned positive at €4.18 million from a previous loss of €6.12 million. Recent activism by Buckley Capital Management highlights strategic opportunities, though management's reluctance to explore a sale raises concerns about maximizing shareholder value.

Dive into the specifics of Basic-Fit here with our thorough growth forecast report.

Upon reviewing our latest valuation report, Basic-Fit's share price might be too optimistic.

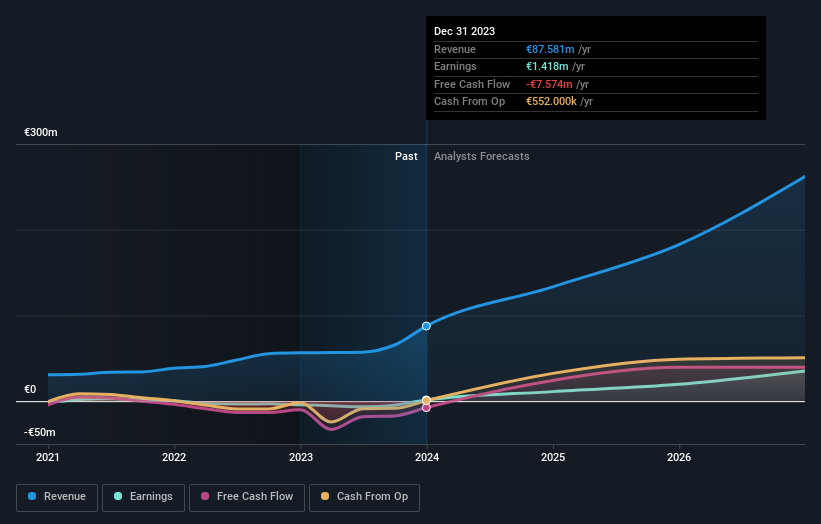

Envipco Holding

Simply Wall St Growth Rating: ★★★★★★

Overview: Envipco Holding N.V. specializes in the design, development, manufacturing, assembly, marketing, sales, leasing, and servicing of reverse vending machines for collecting and processing used beverage containers across the Netherlands, North America, and Europe with a market cap of €305.76 million.

Operations: Revenue Segments (in millions of €): null

Insider Ownership: 36.7%

Earnings Growth Forecast: 83.7% p.a.

Envipco Holding's growth prospects are underscored by a forecasted annual earnings increase of 83.7%, significantly surpassing the Dutch market's average. Despite past shareholder dilution, recent profitability marks a positive shift. Revenue is expected to grow at 34.6% annually, bolstered by substantial orders from Romanian retailers for Optima RVMs. Recent board changes include Mr. George Katsaros' resignation due to health reasons and Ms. Charlotta Gylche's appointment as a non-executive director, alongside BDO Audit & Assurance N.V.'s auditor appointment for 2024.

MotorK

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc, along with its subsidiaries, offers software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market cap of €266.54 million.

Operations: The company's revenue is primarily derived from its software and programming segment, which generated €42.50 million.

Insider Ownership: 35.7%

Earnings Growth Forecast: 108.4% p.a.

MotorK's revenue is forecast to grow at 22.1% annually, outpacing the Dutch market average. Despite a net loss of €6.48 million for the first half of 2024, this marks an improvement from the previous year's €7.8 million loss. The company anticipates profitability within three years, reflecting above-average market growth expectations. Recent executive changes include Zoltan Gelencser's appointment as CFO, bringing extensive global finance experience to strengthen MotorK’s financial strategy amidst its growth trajectory.

Get an in-depth perspective on MotorK's performance by reading our analyst estimates report here.

Our expertly prepared valuation report MotorK implies its share price may be too high.

Where To Now?

Take a closer look at our Fast Growing Euronext Amsterdam Companies With High Insider Ownership list of 6 companies by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTAM:BFIT ENXTAM:ENVI and ENXTAM:MTRK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com