2 High-Yield Financial Stocks to Buy Hand Over Fist and 1 to Avoid

If you're trying to live off the income your portfolio generates, it makes sense that you'd want to own high-yield stocks. But not all high-yield stocks are of the same quality. That's why you should probably avoid Annaly Capital Management (NYSE: NLY).

But sometimes you can find real gems when you focus on yield, which is why you might want to buy Toronto-Dominion Bank (NYSE: TD) and Bank of Nova Scotia (NYSE: BNS). Here's what you need to know about all three of these high-yield financial stocks.

Annaly keeps letting dividend investors down

Annaly Capital Management is a mortgage real estate investment trust (REIT). Unlike a property-owning REIT, it buys mortgages that have been pooled into bond-like securities. This is a very complex niche of the REIT sector. While it's pretty easy to wrap your head around buying a physical property and renting it out (which is what you would do if you bought a rental property), buying mortgage-backed bonds is not something that you would likely be doing on your own.

Some of the factors that can affect mortgage bonds include, but are not limited to, interest rates, housing market dynamics, mortgage repayment rates, and even the year in which a bond was created (often called the vintage). You can keep tabs on interest rates well enough, but all those other issues are pretty tough to monitor if you aren't deeply tracking the mortgage market. Unless you're willing to do a lot of homework, Annaly Capital Management probably isn't for you, even though it has a massive 12.6% dividend yield.

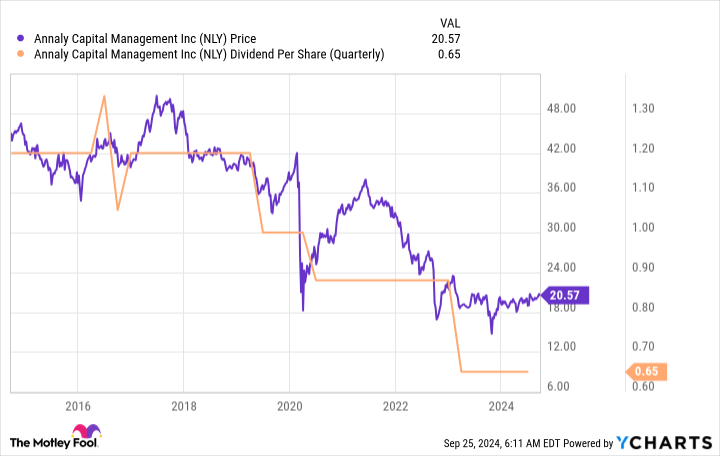

If that yield figure got your attention, you need to check out the graph below. Sure, the yield is high, but the dividend has been heading steadily lower for a decade. The stock has tracked the dividend lower. That's a terrible outcome if you were using the dividends to pay for living expenses in retirement.

To be fair, Annaly Capital Management is a total return vehicle. So dividend reinvestment materially changes the return profile. But most dividend investors are looking to generate spendable income, and Annaly Capital Management won't be a great fit (it's really meant for institutional investors that use an asset allocation approach).

Two better options than Annaly Capital Management

So the ultra-high yield on offer from Annaly Capital Management is probably not right for you. But there are other high-yield financial stocks that will be. Two that will likely tickle your fancy are Toronto-Dominion (or TD Bank) and Bank of Nova Scotia (or Scotiabank). Both are Canadian banking giants. They offer yields of 4.7% and 5.7%, respectively.

Being from Canada is important. The Canadian banking system is heavily regulated -- so much so that the largest banks, which include both TD Bank and Scotiabank, effectively have protected market positions. Moreover, the strict regulation has resulted in generally conservative corporate cultures that permeate all aspects of their businesses. That means there's a solid business foundation in both cases.

So why are the yields so high, considering that the average bank yield is around 2.5%, using the SPDR S&P Bank ETF as a proxy? Both banks are dealing with some internal issues.

TD Bank's money laundering controls weren't up to snuff in the United States, which is going to lead to a huge fine (the bank has already put aside over $3 billion for the expected hit). However, management is confident that the issue will be resolved by the end of 2024. After that point, it will be able to work to regain regulator and shareholder trust. But given the fact that TD Bank has paid dividends every single year since 1857, it seems likely that this problem will eventually pass.

Scotiabank's troubles will probably linger a bit longer than that. It made a differentiated move by focusing on expanding in Latin America while its Canadian peers chose to focus on U.S. expansion. That didn't work out as well as hoped, and now the company has shifted gears. It is working to create a dominant bank that spans from Mexico to Canada. To that end, it recently agreed to buy nearly 15% of KeyCorp. That was a $2.8 billion investment, so Scotiabank is definitely not operating from a position of weakness.

However, this is a long-term play, not one that's going to show results in a few months. But Scotiabank has paid a dividend continuously since 1833, so this is no fly-by-night financial stock, either.

Risks worth taking and risks worth avoiding

If you are trying to live off your dividend income, TD Bank and Scotiabank are fairly low-risk turnaround plays. The high yields will pay you well while you wait for better days, which seem highly likely to show up, eventually. Annaly Capital Management, on the other hand, has a volatile dividend history and is really a total return investment. Don't get sucked in by the high yield -- history suggests it will only end up disappointing you in the end.

Should you invest $1,000 in Annaly Capital Management right now?

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Reuben Gregg Brewer has positions in Bank Of Nova Scotia and Toronto-Dominion Bank. The Motley Fool recommends Bank Of Nova Scotia. The Motley Fool has a disclosure policy.

2 High-Yield Financial Stocks to Buy Hand Over Fist and 1 to Avoid was originally published by The Motley Fool